doordash quarterly tax payments

And Local Quarterly Sales and Use Tax Return for Part-Quarterly Filers but distributors who have used these fuels or sold them at retail may take credits on Form ST-809 or Form ST-810 for. Convinced a New York federal court Monday to compel arbitration of a consumers claims and pause a would-be class suit alleging it misled consumers by.

Is My Mileage Deduction Normal Just Like Yours About Half The Income Deducted R Doordash

So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

. No Delivery Fees on Your First Order Order from Your Favorite Restaurants Today. - Nous subissons actuellement une panne avec notre support en français. Tax Forms to Use When Filing DoorDash Taxes.

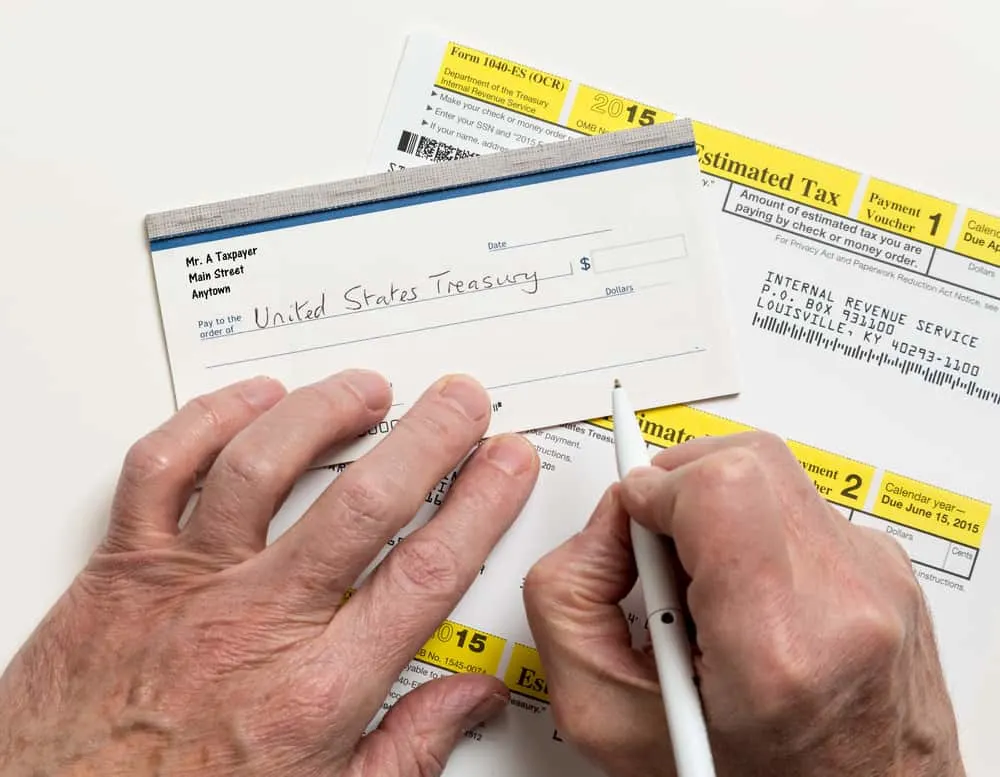

Fill out the 1040-ES payment voucher. 100 of prior year taxes. You can unsubscribe to any of the.

You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year. Select the By mail option. In spite of not getting a W-2 your income tax filing process wont differ much from those with traditional employment.

Ad From National Restaurants to Local Mom Pops DoorDash Delivers the top Restaurants. 90 of current year taxes. In QuickBooks Self-Employed go to the Taxes menu.

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier Doordash Taxes Made Easy Ultimate. Thank you for your continued DoorDash partnership. Technically both employees and independent contractors.

Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. If you earned at least 600 during the year youll need to submit a 1099 form to the IRS. 110 of prior year taxes.

Your late fee is gonna be like 10 if that lol. No Delivery Fees on Your First Order Order from Your Favorite Restaurants Today. DoorDash will send you tax form 1099.

Ad From National Restaurants to Local Mom Pops DoorDash Delivers the top Restaurants. Internal Revenue Service IRS and if required state tax departments. Instructions for doing that are available through the IRS using form 1040-ES.

How Do Taxes Work with DoorDash. The standard FUTA tax rate is currently 60 on the first 7000 of taxable wages per employee which means that the maximum tax employers have to pay per employee per tax. Dasher 1 year.

Here are the due dates for 2021. DoorDash will issue a 1099. A 1099-NEC form summarizes Dashers earnings as independent.

4d edited 4d. Well You estimate the taxes that will be owing on your earnings. Youll receive a 1099-NEC if youve earned at least 600.

Each quarter youre expected to pay taxes for that quarters payment period. How to Pay Doordash Taxes. Make sure to pay estimated taxes on time.

How much can you make on DoorDash without paying taxes. DoorDash drivers are expected to file taxes each year like all independent contractors. The forms are filed with the US.

You can also use the IRS website. Si vous avez besoin dassistance en. Paying quarterly taxes which arent actually quarterly by the way takes literally 30 seconds.

Select the Quarterly Taxes tab. Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party. Answer 1 of 5.

Then provide your 1099 to your CPA or. If you made estimated tax payments in 2020 towards your federal state or local taxes enter them in the Estimated and Other Income Taxes Paid section. All income you earn from any source must be reported to the IRS and your states Department of Revenue.

First calculate your total Doordash earnings. You must make quarterly estimated tax payments for the current. AGI over 150000 75000 if married filing separate 100 of current year taxes.

Dashers will not have their income withheld by the. Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes. Each year tax season kicks off with tax forms that show all the important information from the previous year.

The self-employment tax is your Medicare and Social Security tax which totals 1530. Answer 1 of 4.

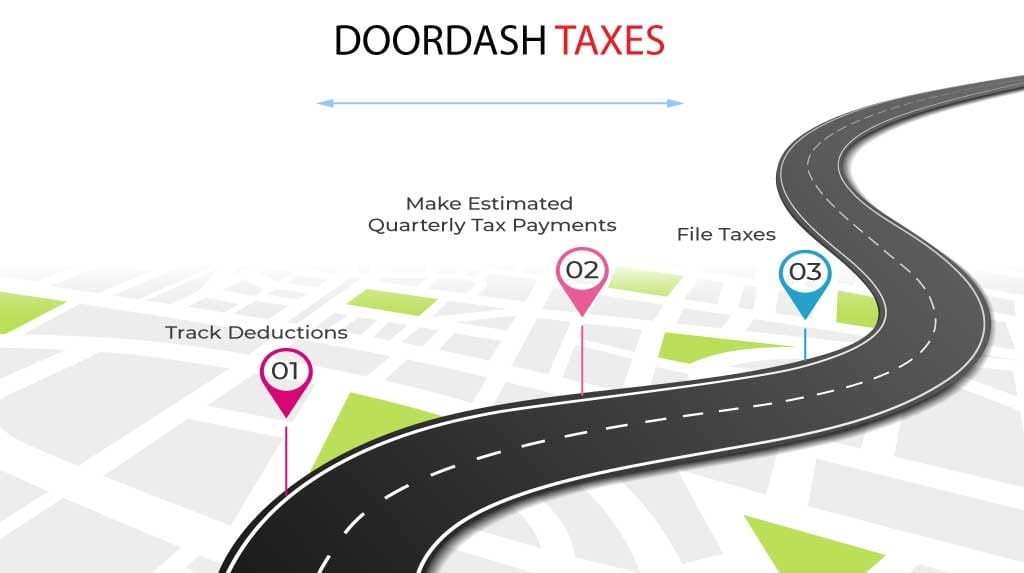

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Does Doordash Do Taxes Taxestalk Net

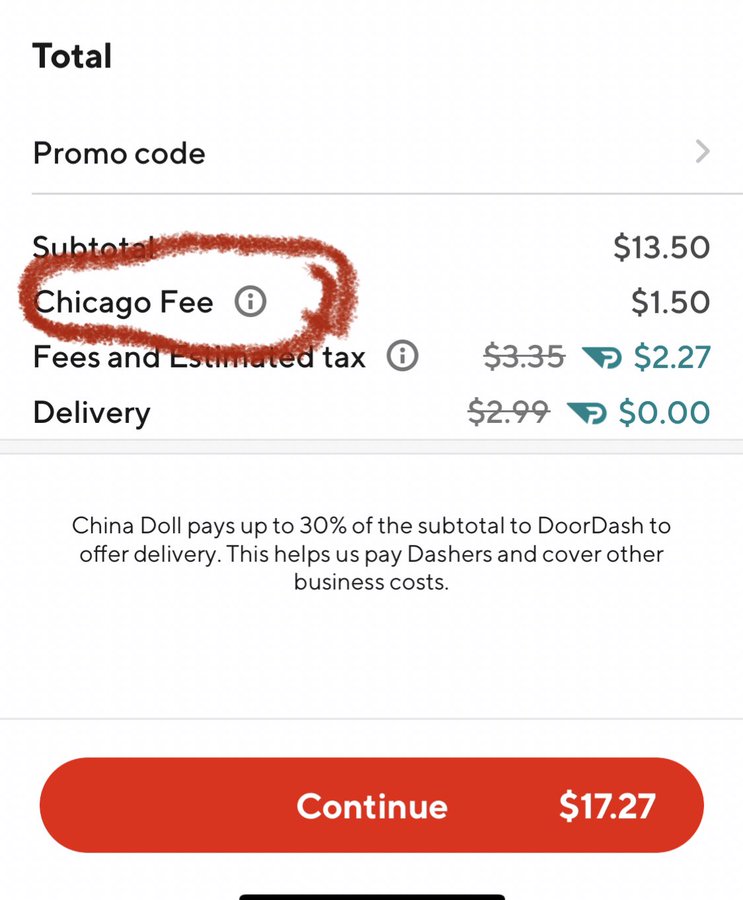

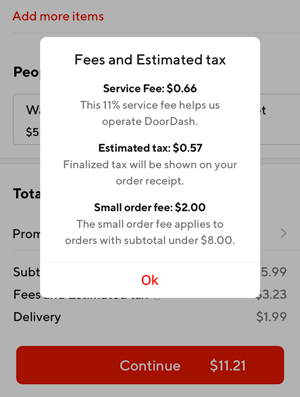

What Is This Service Fee And Does The Dasher Get It Not Sure If I Ever Noticed Them R Doordash

How Do I File Doordash Quarterly Taxes Due Septemb

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

New Doordash Fees In Nearly A Dozen Markets Frustrate Diners Officials

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

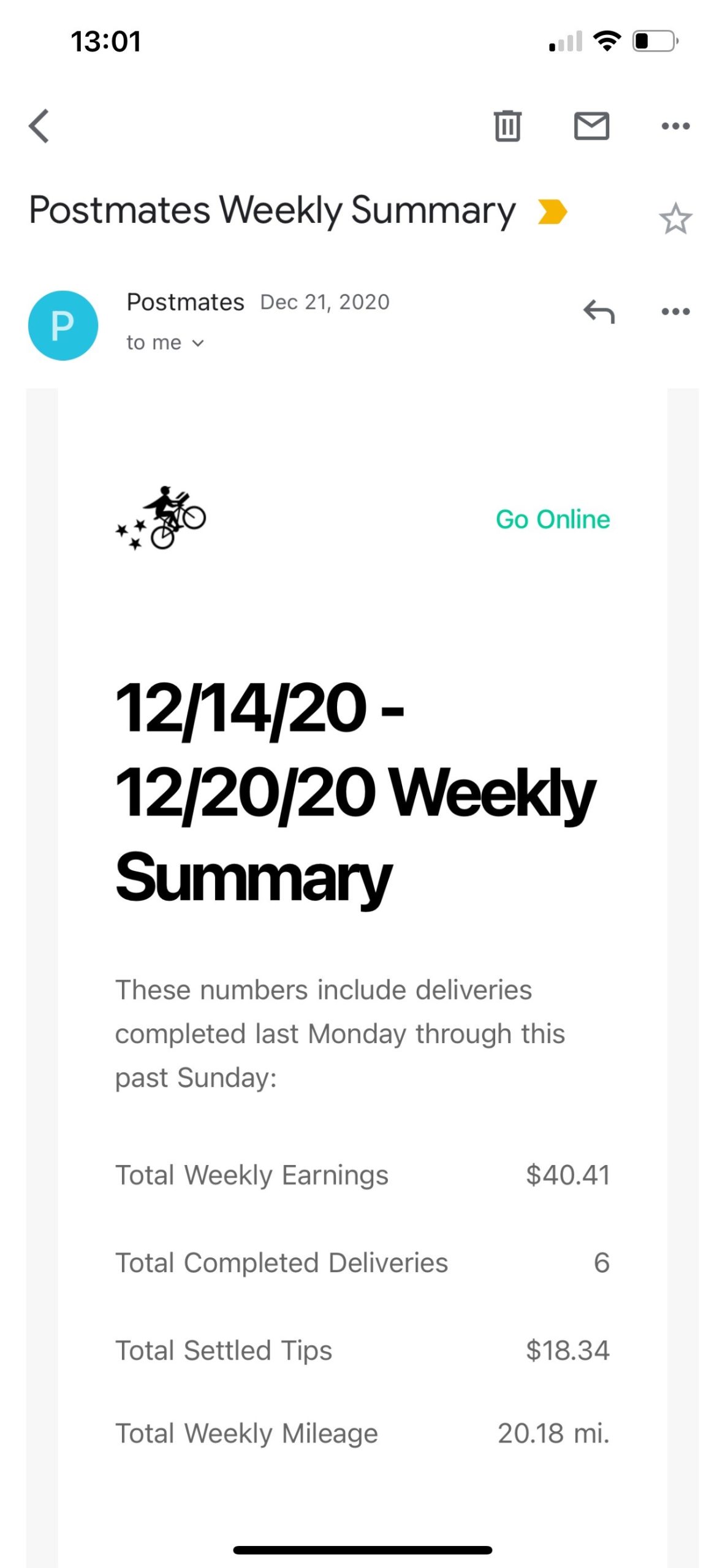

Dasher Pay Breakdown R Doordash

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras